ST. GEORGE — Utah’s Republican legislative leaders rolled out a promised tax relief package Thursday that is projected to result in a $400 million tax cut. The move builds on previous tax cuts passed by the Legislature over the last two years.

The tax relief legislation – House Bill 54 – proposes to reduce the income tax from 4.85% to 4.65%, which will translate to annual tax break of $208 (or $17 a month) for an average Utah family of four that makes $80,000 a year.

“We firmly believe money is best used when left in the pockets of our citizens and we’ve clearly demonstrated that the past few years,” House Speaker Brad Wilson said in a press release Thursday.

“The best way we can ensure Utahns can continue calling Utah home is by passing family and business-friendly policies, including reducing taxes. I am thrilled that we once again are considering historic tax relief and know Utahns will benefit for years to come.”

The Legislature has passed nearly $300 million in tax cuts over the last two years. As with prior bills of this nature, House Bill 54 incorporates various tax-cutting measures originally proposed in other bills. This includes St. George Rep. Walt Brooks’ HB 88 and Clearfield Rep. Karianne Lisonbee’s House Bill 275.

An overall breakdown of what lawmakers say HB 54 will do if passed:

- Reduce all Utahns’ income tax rate from 4.85% to 4.65%.

- Expand Social Security tax credit eligibility to individuals earning up to $75,000 per year (from Brooks’ bill).

- Provide a tax benefit for pregnant women by allowing a double dependent exemption for children in the year of their birth (from Lisonbee’s bill).

- Increase the earned income tax credit (EITC) from 15% to 20% of the federal credit.

As for how the tax cuts relate to Utah households, according to a press release issued by the Legislature Thursday, low-income households will see about a 22% tax cut, middle-income households will see about a 6% tax cut and high-income households will see about a 4% tax cut.

“2023 will be the year of the tax cut again, again, again,” Senate President J. Stuart Adams said in the Thursday press release. “For the third year in a row, we will return money to the hard-working Utahns who earned it. We will continue to promote long-term investments that help families, individuals and businesses succeed.”

While the income tax break is more than the 4.75% originally put forth by Gov. Spencer Cox in his state budget proposal in December 2022, the overall $400 million tax cut is also smaller than the $1 billion proposed by the governor. Around $300 million in the governor’s proposal would be applied to ongoing income tax cuts while $574 million would provide one-time tax relief.

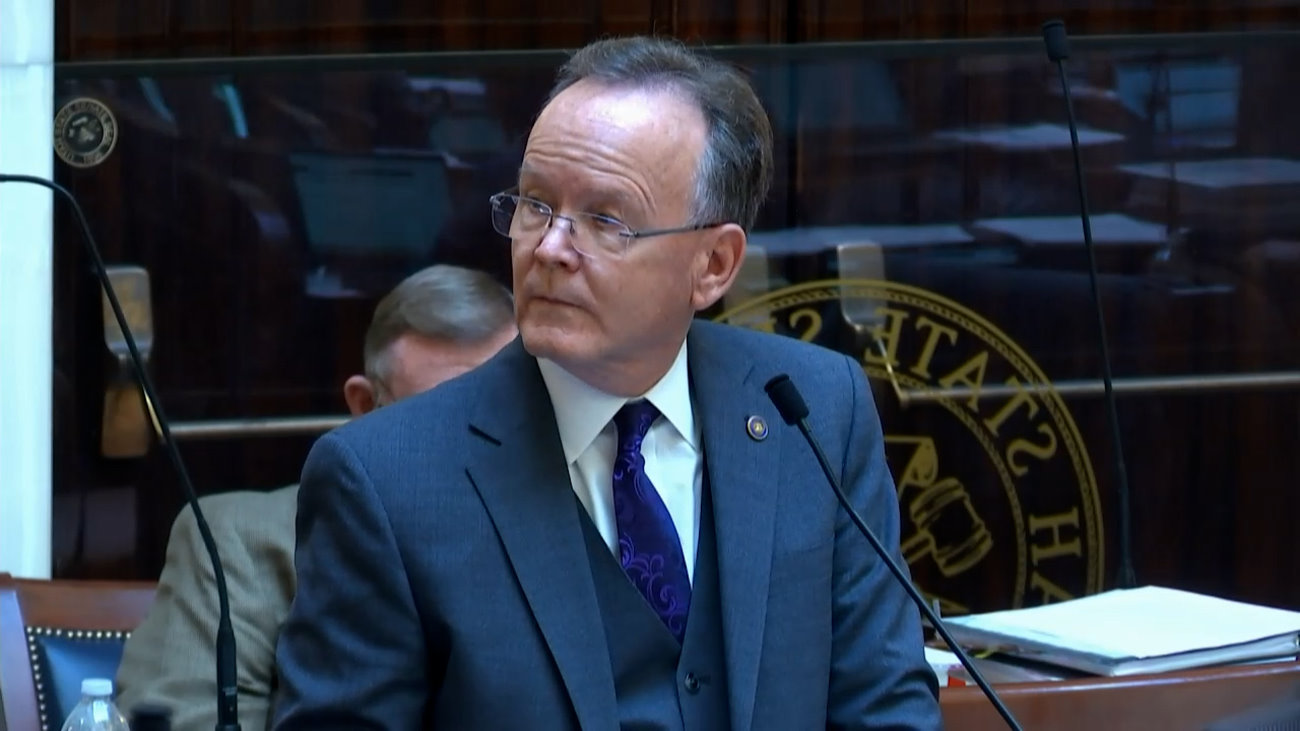

Brooks told St. George News Friday afternoon that he is grateful his proposed Social Security tax cut was incorporated into HB 54. While he said the bill did not adopt the entirety of his proposal, it will help push forward the goal of eventually eliminating the state tax on Social Security.

As to whether Utah may seek to eliminate its overall income tax at some point as other states have, Brooks said that was unlikely.

“It’s a big part of how the state is funded,” Brooks said, yet he also echoed Wilson and Adams’ statements on letting taxpayers keep more of their money.

“In order to create wealth in the thriving economy that we have, putting the money back in the people’s hands will do a lot better job than in the government’s hands. We want to do everything we can and are working together to try and make these tax cuts as big and deep as possible.”

Brooks is among HB 54’s House co-sponsors, as are fellow Southern Utah Reps. Colin Jack and Rex Shipp. The bill’s original sponsor is Rep. Steve Eliason of Sandy, with Sen. Daniel McCay of Salt Lake City serving as the bill’s Senate floor sponsor.

As of Friday afternoon, the language of the bill has yet to be updated from its original version. A substitute bill with revised language will likely be rolled out next week when the bill is presented to the House Revenue and Taxation Committee for consideration.

The House committee hearing will be held on Tuesday, Feb. 21, at 8 a.m. at the state Capitol. A live stream of the hearing will be available for viewing through the Utah Legislature’s website.

While not included in HB 54, the Legislature is taking on the issue of repealing the state’s food tax, albeit in a somewhat indirect manner.

According to a press release issued Friday, the Legislature will also begin to consider House Bill 101, the food tax sales amendments, next week. HB 101 seeks to repeal the state’s portion of sales tax on food. However, this will be tied the removal of a constitutional earmark governing how income tax revenue is used.

“Utahns have informed lawmakers that removing the sales tax on food is a priority,” the press release states. “While Utah’s economy is robust, the state’s current budget structure creates funding constraints. Currently, the Utah Constitution mandates all income tax revenue be used only for certain items.”

The state’s sale tax is earmarked to go toward the higher and public education and will require a constitutional amendment to change. This means the issue will go to the ballot box in November for Utahns to consider if HB 101 passed the Legislature.

“Utah is the only state in the nation that has these types of budget constraints,” said Rep. Mike Schultz. “We can’t remove the sales tax on food and continue to efficiently balance the state budget. I’m excited to give citizens the opportunity to make the final decision at the ballot box next November.”

Check out all of St. George News’ coverage of the 2023 Utah Legislature here.

Copyright St. George News, SaintGeorgeUtah.com LLC, 2023, all rights reserved.